Tax withholding calculator 2020

Find Everything You Need To Quickly Finish Your Past Years Taxes. Discover Helpful Information And Resources On Taxes From AARP.

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Tax withheld for individuals calculator.

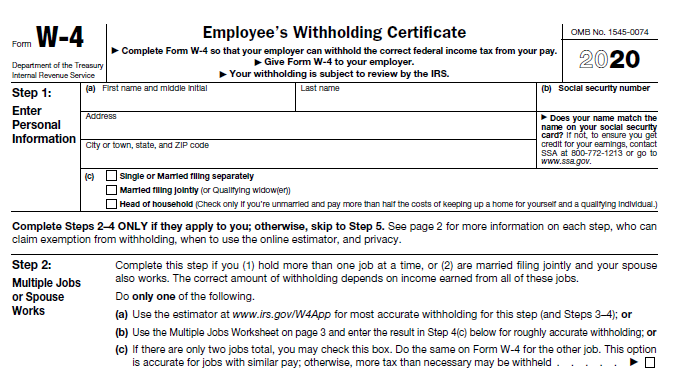

. Change Your Withholding. Choose the right calculator. Since early 2020 any.

Check out HR Blocks new tax withholding calculator and learn about the new W-4 tax form updates for 2020 and how they impact your tax withholdings. Use our tax withholding calculator to see how to adjust your W-4 for a bigger tax refund or more take-home pay. 250 minus 200 50.

Median household income in 2020 was 67340. In fact the Tax Withholding. Ad Complete Past Years Taxes And Get Your Maximum Refund Guaranteed.

For help with your withholding you may use the Tax Withholding Estimator. Our free W4 calculator allows you to enter your tax information and adjust your paycheck. Please visit our State of Emergency Tax Relief.

H and R block Skip to content. Complete a new Form W-4 Employees. Please refer to 2020 Form W-4 FAQs if you have questions regarding the changes in the new 2020 Form W-4 compared to the 2019 Form W-4.

Up to 10 cash back Maximize your refund with TaxActs Refund Booster. Thats where our paycheck calculator comes in. Then look at your last paychecks tax withholding amount eg.

Businesses impacted by recent California fires may qualify for extensions tax relief and more. Accordingly the withholding tax. If you have any questions please contact our Collection Section at 410-260-7966.

The Writers Guild-Industry Health Fund and the Producer-Writers Guild of America Pension Plan collectively FundPlan administer health and pension benefits for eligible writers. Earnings Withholding Calculator. There are 3 withholding calculators you can use depending on your situation.

The Tax withheld for individuals calculator is. Estimate how much youll owe in federal taxes using your income deductions and credits all in just a few steps with our tax calculator. Do not use periods or commas.

You can use the Tax Withholding. To change your tax withholding use the results from the Withholding Estimator to determine if you should. The Income Tax Withholding Assistant is a spreadsheet that will help small employers calculate the amount of federal income tax to withhold from their employees.

States dont impose their own income tax for tax year 2022. The application is simply an automated computation of the withholding tax due based only on the information entered into by the user in the applicable boxes. 250 and subtract the refund adjust amount from that.

Oregon personal income tax withholding and calculator Currently selected. That result is the tax withholding amount. Other Oregon deductions and modifications.

Step 1 incomplete Personal Info Step 2 incomplete. 2021 Personal income tax calculator. Effective tax rate 172.

Quarterly Estimated Tax Calculator - Tax Year 2022. The information you give your employer on Form W4. The withholding rate may be lower i Severance Pay is taxable based on the years of service rendered in Delaware The Budget 2020 has recently announced the new tax regime.

Enter your taxable income from Form OR-40 line 19. Ad Enter Your Status Income Deductions And Credits And Estimate Your Total Taxes. Skip to main app content.

Tax Withholding For Pensions And Social Security Sensible Money

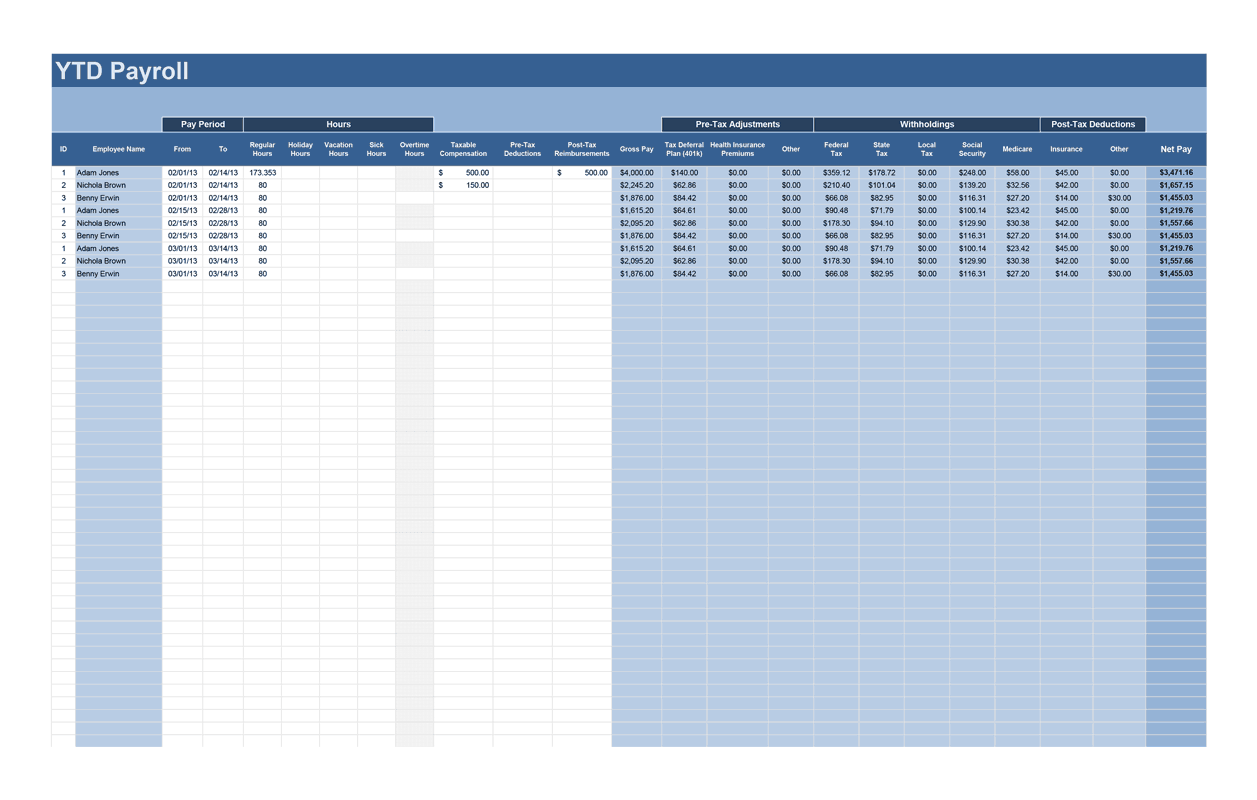

How To Calculate Payroll Taxes Methods Examples More

Payroll Calculator Free Employee Payroll Template For Excel

Mathematics For Work And Everyday Life

Calculating Federal Income Tax Withholding Youtube

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Irs Releases Tax Withholding Assistant For Employers Erp Software Blog

Is There A Wage Minimum Limit Before Federal Tax Is Withheld My W 2 Shows No Federal Tax Withheld On My Line 1 Wages Of 4657 89

Income Tax Rates For The Self Employed 2020 2021 Turbotax Canada Tips

2022 Income Tax Withholding Tables Changes Examples

How To Calculate 2021 Federal Income Withhold Manually With New 2020 W4 Form

Payroll Tax What It Is How To Calculate It Bench Accounting

Irs Improves Online Tax Withholding Calculator

How To Calculate Federal Income Tax

Calculation Of Federal Employment Taxes Payroll Services

Calculation Of Federal Employment Taxes Payroll Services

How To Calculate Federal Income Tax